Goldman: «Холодный январь» и «рекордный спрос на СПГ» повышают риски

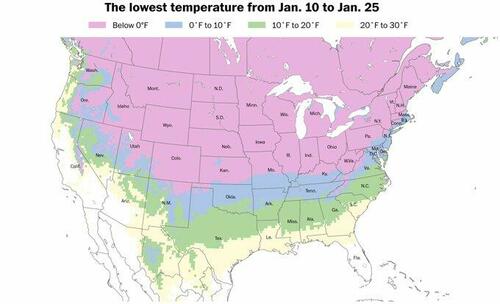

Бен Нолл, метеоролог из Национального института водных и атмосферных исследований Новой Зеландии, написал на X, что нижний 48 готовится к еще одному «крупному арктическому взрыву» за десять дней.

Крупный арктический взрыв может покрыть большую часть Соединенных Штатов холодными условиями вокруг Яна. 20

Смотреть: pic.twitter.com/8NcSVx3fqJ

— Ben Noll (@BenNollWeather) 10 января 2025 г.

«Нулевые температуры прогнозируются в более чем 35 штатах в течение следующих двух недель», — сказал Нолл.

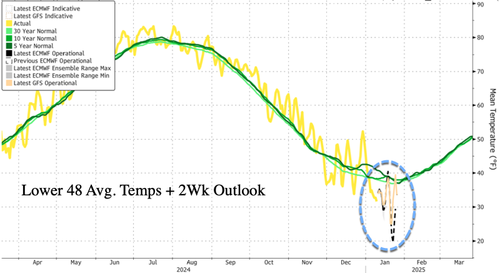

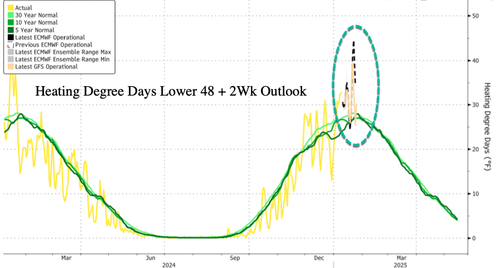

Данные, собранные Bloomberg, показывают, что более низкие 48 средних температур к 20 января могут быть около 20F, что значительно ниже средних значений за 30-10-5 лет, которые имеют тенденцию к высоким 30F.

Дни с температурой, измерение того, насколько холодна температура и сколько энергии необходимо для нагрева здания, для нижних 48, как ожидается, взлетят в последние части месяца. Это говорит о том, что спрос на энергию будет еще выше.

Продолжающийся холодный взрыв и еще один раунд холодных температур, вероятно, будут стимулировать спрос на отопление и поддерживать более высокие цены на NatGas, поскольку поставки ужесточаются в промежуточные сроки, по словам соруководителя Goldman Sachs Global Commodities Research Саманты Дарт.

Дарт отметила, что исключительно холодный январь и рекордно высокий экспорт СПГ ужесточили поставки, вынудив ее пересмотреть свой прогноз Henry Hub на лето 2025 года в 2,90 доллара / мм Btu до 3,30 доллара / мм Btu. Перспектива роста экспорта СПГ оставляет цель аналитика на 2026 год в $4/ммБту.перекошенный вверх ногами"

Она предоставила больше информации о динамике спроса и предложения NatGas в 2025 и 2026 годах.

Исключительный холод представляет значительный риск для спроса на газ в США в этом месяце. В настоящее время прогнозируется, что январь будет на 1,3 стандартных отклонения холоднее, чем в среднем по США, что может поднять спрос на газ в США в этом месяце на 6,1 Bcf/d выше, чем мы ожидали бы при средней погоде. Вместе с замораживанием производства (1,2 млрд куб. футов в месяц на сегодняшний день[1]) и сильным спросом на СПГ, а также из-за смягчающих сюрпризов от канадского импорта и экспорта в Мексику, январские газовые балансы США могут быть на 6,4 млрд куб. футов в сутки более жесткими, чем мы ожидали, если текущие холодные прогнозы осуществятся, что создает риск для нашего прогноза Генри Хаба на лето 2025 года в 2,90 доллара США / мм.

Рекордно высокий спрос США на газ для экспорта СПГ также ужесточает баланс. Мы отмечаем, что американский газ на экспортных объектах СПГ достиг рекордно высокого среднего показателя в 14,5 Bcf/d в неделю (против GSe в 14 Bcf/d за январь), а Plaquemines загрузили свои первые вводимые в эксплуатацию грузы. С расширением Cheniere Corpus Christi Stage 3, начиная с этого года, мы ожидаем, что общий объем отработанного газа в США на экспортных объектах СПГ в этом году составит в среднем около 15 Bcf / d (+ 2,3 Bcf / d yoy), достигнув 16,7 Bcf / d к концу года.

Чистое воздействие на хранение снижает риски перегрузки к 2025 году. В то время как этот более жесткий, чем ожидалось, январь, если он подтвердится, будет представлять собой около 200 Bcf влияние на хранение, чистое влияние на наши ожидания на конец октября 25 значительно смягчается ударом от недавнего резкого роста цен на газ в США до спроса на газ. В целом, если текущий расширенный холодный прогноз на январь осуществится, это приведет к тому, что наше ожидание хранения в конце октября 25 года будет на 51 Bcf ниже нашей оценки Nov24, на 4,05 Tcf.

Это означает, что снижение C2G, вероятно, потребуется в этом году по сравнению с нашими предыдущими ожиданиями. Хотя такие уровни все еще относительно высоки, они предполагают, что рынок потребует меньше замещения угля на газ (C2G), чем мы в настоящее время встраиваем в наши балансы. Это означает, что Sum25 Henry Hub может потенциально сбалансировать рынок ближе к $3,30 / мм Btu (по сравнению с нашим текущим прогнозом летних цен на $2,90 / мм Btu), который, по нашим оценкам, будет достаточно ниже текущих рыночных цен, чтобы стимулировать постепенное переключение C2G на хранение в конце октября 25 под 4 Tcf.

Ужесточение рисков частично смягчается повышательным риском для производства попутного газа. Эти более жесткие риски для наших балансов, по крайней мере, частично смягчаются за счет смягчения рисков для наших предположений о добыче попутного газа в США. На нашей конференции по энергетике, экологически чистым технологиям и коммунальным услугам, состоявшейся в Майами на этой неделе, пермские производители и компании среднего звена указали на ожидания регионального роста объемов нефти и попутного газа, аналогичного тому, что мы видели в 2024 году. Это будет означать до 0,4 Bcf/d риска роста до 22,2 Bcf/d добычи пермского попутного газа, которую мы ожидаем увидеть в среднем в 2025 году, что составляет ~ 2 Bcf/d по сравнению с 2024 годом.

В то время как мы приобрели повышенную уверенность в нашей квартире Haynesville объемы ожидания. На конференции производители Haynesville подтвердили наше мнение о том, что региональная добыча газа вряд ли вырастет в этом году с ценами на Cal25 Henry Hub около $3,50 / мм Btu. Производители указали, что включение новых скважин и завершение буровых, но незавершенных (DUC) скважин, вероятно, компенсирует снижение природного бассейна, сохраняя общий уровень добычи в значительной степени неизменным.

Повышенный риск для наших бычьих $4/ммBtu 2026 Прогноз Генри Хаба. Важно отметить, что, учитывая повышенную волатильность цен на газ и риски баланса, производители указали на необходимость устойчивого буфера цен на газ в дополнение к предполагаемым предельным издержкам производства для перехода бассейна в режим роста. В частности, они указали, что для стимулирования роста, вероятно, потребуются цены в размере 4-5 долларов США / мм Btu, что выше наших предполагаемых предельных затрат в размере 3,50 долларов США / 3,75- 4,00 долларов США (неосновные) в Хейнсвилле. Учитывая наше мнение о том, что значительное увеличение экспорта СПГ в США потребует возобновления роста производства в Хейнсвилле в 2026 году, мы считаем, что это оставляет риски для нашего прогноза цен на Генри Хаб на 4 доллара / мм Btu 2026.

Цены на NatGas тестируют на уровне $4/мм Уровень Btu после очистки уровня $3/ммBtu в конце ноября. Цены застряли в многолетнем боковом тренде после падения с почти $10/мм Btu в середине 2022 года.

Дарт также видит риски роста цен в NatGas.

Goldman Sachs видит «значительные риски» роста цен на газ в ЕС на фоне «холодного спада» в Европе https://t.co/D1x5qzFOHZ

— zerohedge (@zerohedge) 4 января 2025 г.

И считает, что Европа может заменить российский СПГ американским СПГ во время Трампа 2.0

«Теоретически да»: Goldman говорит, что американский СПГ может заменить российский импорт СПГ в ЕС https://t.co/vD4eBOxupK

— zerohedge (@zerohedge) 25 декабря 2024 года

Все внимание обращено на уровень US NatGas в $4.

Тайлер Дерден

Сат, 01/11/2025 - 09:55