Ether Treasuries поднимется до 13 миллиардов долларов, когда цена упадет до 4300 долларов

Автор Exra Reguerra через CoinTelegraph.com,

Общий Ether, принадлежащий компаниям с криптоказначейскими облигациями, вырос до 3,04 миллиона ETH на сумму 13 миллиардов долларов, поскольку цена криптовалюты выросла до 4300 долларов.

В понедельник, Эфир поднялся до $4 332, поднявшись на 20,4% за последние семь днейОб этом сообщает CoinGecko.

На момент написания статьи ETH немного снизился и находился на уровне 4290 долларов.

Ралли ETH подпитывается компаниями, увеличивающими свои активы за последние 30 дней.

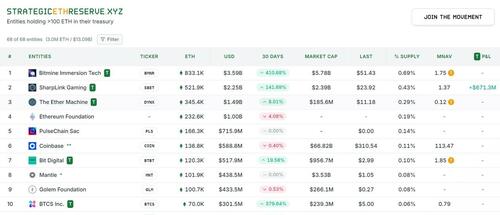

BitMine Immersion Technologies, которая возглавляет список держателей казначейских облигаций ETH, увеличила свои запасы до 833 100 ETH, что на 410,68% больше, чем ETH за последние 30 дней.

[ZH: Обновление] BitMine в понедельник объявила, что по состоянию на 10 августа она владела в общей сложности 1,15 млн ETH, что делает компанию крупнейшим казначейством ETH в мире. Общая стоимость ETH-холдингов компании составила $4,96 млрд, по сравнению с $2,9 млрд, о которых сообщалось неделей ранее.

«Всего за неделю BitMine увеличила свои активы ETH на 2,0 миллиарда долларов до 4,96 миллиарда долларов (с 833 137 до 1,15 миллиона токенов), молниеносная скорость в погоне за «алхимией 5%» ETH», - сказал Том Ли из Fundstrat, который недавно был назначен председателем совета директоров BitMine.

SharpLink Gaming последовала за 521 900 ETH после увеличения своего казначейства на 141,69% за тот же период времени, в то время как The Ether Machine выросла на 8,01% до 345 400 ETH.

На эти три предприятия приходилось более половины ETH, принадлежащего 10 крупнейшим казначейским компаниям ETH, которые имели в общей сложности 2,63 млн ETH, что составляет около 2,63% от общего объема предложения актива.

Топ-10 организаций, владеющих эфиром. Источник: Strategic ETH Reserve

Топ-10 казначейских организаций ETH владеют более $11,3 млрд

Рост цен на неделе резко повысил стоимость корпоративных активов ETH.

В минувший понедельник BitMine купила 208 137 ETH, поставив свои активы в 833 100 ETH. В то время активы стоили около 2,9 миллиарда долларов, поскольку ETH колебался около 3700 долларов.

Поскольку ETH торгуется на уровне около 4300 долларов, активы BitMine теперь стоят более 3,58 миллиарда долларов, что делает его первой компанией, которая владеет более чем 3 миллиардами долларов в ETH.

Во вторник инвестиционная компания SharpLink увеличила свои активы до 521 900 ETH после покупки 83 562 ETH.

В то время активы SharpLink оценивались примерно в 1,91 миллиарда долларов. С ростом цен ETH за 4300 долларов, ETH компании теперь стоит более 2,23 миллиарда долларов.

ETH Treasury Data Tracker Strategic ETH Reserve (SER) показал, что SharpLink Gaming имеет более $671 млн нереализованной прибыли от своих инвестиций в эфир.

3 августа The Ether Machine купила 15 000 ETH, что совпало с 10-летием Ethereum. По данным SER, в воскресенье компания добавила в свою казну еще 10 600 ETH. В настоящее время он владеет 345 362 ETH на сумму почти 1,5 миллиарда долларов, удерживая его в первой тройке по холдингам.

Помимо крупнейших компаний, на прошлой неделе были сделаны небольшие покупки. В пятницу биржа HashKey объявила, что зарегистрированная в Гонконге IVD Medical приобрела HK$149 млн (около $19 млн) в ETH с торговой платформы. Однако фактическая сумма ETH не была раскрыта.

В целом, данные SER показывают, что 64 казначейские компании, которые владеют ETH, имеют в общей сложности 3,04 миллиона ETH на сумму более 13 миллиардов долларов США по текущим рыночным ценам.

Количество ETH, принадлежащих казначейским компаниям. Источник: Strategic ETH Reserve

Рыночная капитализация Ethereum превысила MasterCard

В понедельник рыночная капитализация Ethereum выросла до $523 млрд. Рост на 21% в эфире за последние семь дней превысил отметку в 4000 долларов. На момент публикации он торговался на уровне $4 332.

Рыночная капитализация Ether обогнала платежный гигант Mastercard Рыночная капитализация компании составляет $519 млрд, по данным CompaniesMarketCap.

Более 304 000 ETH, стоимостью более 1,3 миллиарда долларов, были добавлены публичными компаниями, которые имеют казначейские обязательства Ether на прошлой неделе.

Погружение BitMine На прошлой неделе Technologies купила львиную долю ETH, поскольку компания купила более 208 000 ETH на сумму более 900 миллионов долларов, а затем SharpLink Gaming купила Ether на 303 миллиона долларов.

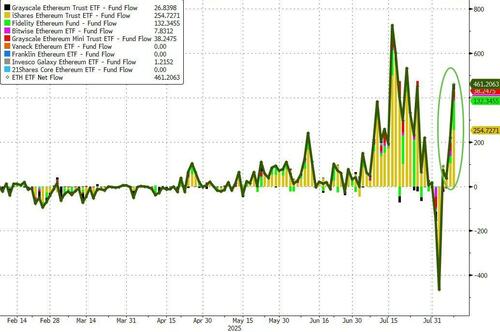

Вместе с Эфиром Спрос казначейства, приток ETH ETF снова вырос

Аналитики оптимистично относятся к ценовому действию ETH

Технические аналитики также стали бычьими на эфире. Некоторые предсказывают, что актив может достичь отметки в 20 000 долларов впервые в ближайшие месяцы.

Аналитик Нилеш Верма сказал, что ETH может достичь рубежа в 20 000 долларов в ближайшие шесть-восемь месяцев на основе исторических ценовых фракталов.

Тем временем, Мерлийн Трейдер, технический аналитик, предсказал, что актив может превысить 20 000 долларов и даже превысить эту отметку.

С другой стороны, некоторые отраслевые эксперты предупреждают инвесторов.

Соучредитель Ethereum Виталик Бутерин поддержал компании, которые покупают эфир для хранения в своих соответствующих казначейских облигациях; однако он предупредил, что он не должен превращаться в «игру с заемными средствами», которая может привести к падению актива.

Тайлер Дерден

Мон, 08/11/2025 - 11:00