Означает ли неудача Porsche конец превосходства Германии в автомобилях?

Акции Porsche AG упали почти на 10% на прошлой неделе - самое резкое падение с момента дебюта в 2022 году - после того, как автопроизводитель сократил свои амбиции в области электромобилей. Акции упали почти на 30% в этом году и выпадут из базового индекса DAX в Германии. По данным Bloomberg, материнская компания Volkswagen также упала на 8,4%, что является самым резким падением за последние два года.

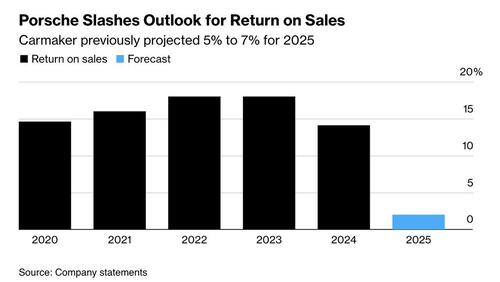

Производитель 911 отказался от планов роскошного внедорожника с батарейным питанием и вместо этого расширит свою линейку автомобилей с двигателем внутреннего сгорания и гибридных автомобилей. Сдвиг вызвал удар в размере 1,8 млрд евро по операционной прибыли, что стало четвертым предупреждением Porsche о прибыли в этом году, и подтолкнуло Porsche и VW к сокращению прогнозов прибыли. VW также отметил обесценение в размере 3 млрд евро, связанное с этим шагом, снизив свой прогноз операционной прибыли от продаж до всего лишь 2% до 3%, по сравнению с целых 5%.

Bloomberg пишет, что покупатели автомобилей «Мы мало ценим роскошные электромобили». Маттиас Шмидт, независимый аналитик из Гамбурга. «Порше осознала это и возвращается к моделям двигателей внутреннего сгорания с высокой маржой. "

Эта неудача подчеркивает более широкую борьбу автомобильного сектора Германии. Porsche сталкивается со слабым спросом в Китае, где местный чемпион BYD доминирует над электромобилями. США сильно пострадали от тарифов на своем крупнейшем рынке. Расходы на роскошь приглушены, и аналитики говорят, что Porsche разочаровал инвесторов с момента своего листинга блокбастеров. «Порше разочаровывает инвесторов уже более двух лет», — написал Харальд Хендриксе из Citi. «Трудно сделать вывод о том, что эти разочарования уже завершились. "

Volkswagen, который когда-то был лидером в области электромобилей, также сокращает планы батарей и реструктуризацию, чтобы сократить расходы. В то время как VW превзошел Tesla, Stellantis и BYD в Европе в этом году с несколькими доступными электромобилями, его премиальные бренды — Audi, Bentley, Lamborghini и Ducati — ослабли.

Porsche уже заменил руководителей, отказался от собственной программы аккумуляторов и объявил о сокращении рабочих мест, чтобы сократить расходы. Но кризис подпитывает призывы к генеральному директору Оливеру Блюму, который возглавляет Porsche и VW, отойти от управления Porsche, чтобы новый лидер мог попытаться изменить ситуацию.

Тайлер Дерден

Фри, 09/26/2025 - 02:45