Мумбаи- В последнее время наблюдается рост международных перевозчиков, сокращающих свои рейсы в Китай, причем British Airways (BA) становится последней, кто сокращает маршрут Лондон Хитроу (LHR) - Пекин (PKX).

Международные авиалинии ссылаются на различные причины сокращения или сокращения этих услуг в Китае, включая слабый спрос на поездки, политическую напряженность, рост эксплуатационных расходов и продолжающееся воздействие пандемических сбоев COVID-19. Закрытие российского воздушного пространства из-за конфликта на Украине еще больше усложнило полеты, увеличив расходы и время полета для многих перевозчиков.

Источник: Cado Photo

Источник: Cado PhotoBritish Airways сокращает рейсы в Китай

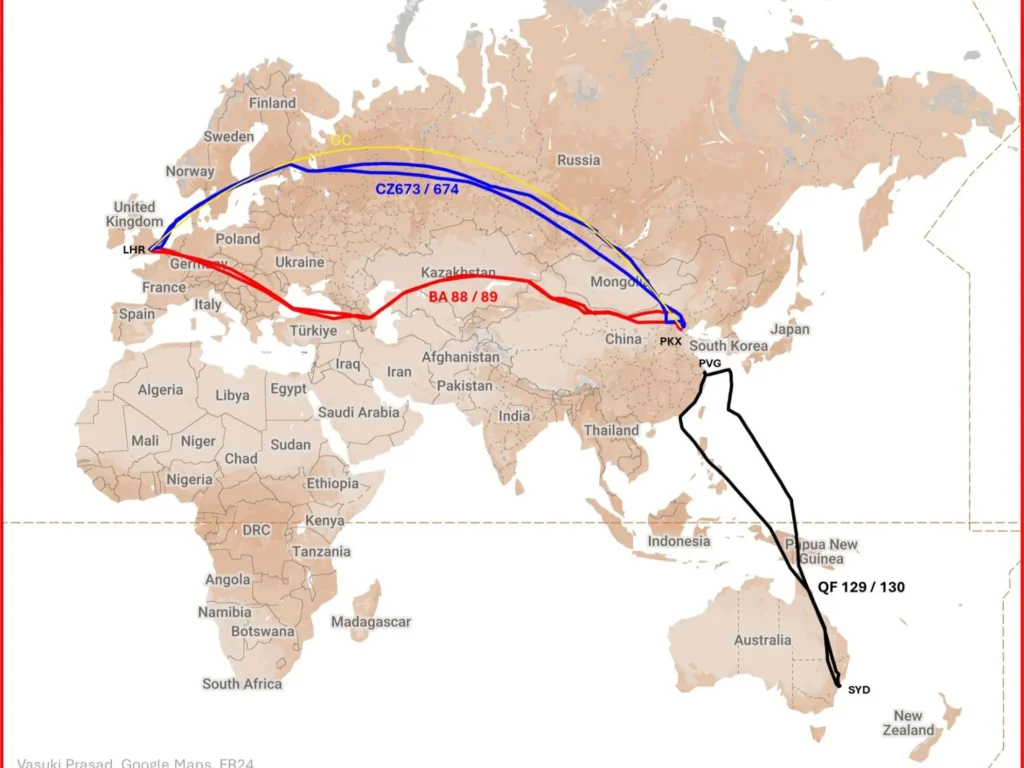

Ответ на многие вопросы мы нашли в подробном анализе Васуки Прасада в его посте в LinkedIn. Он является авиационным аналитиком, директором по маркетингу в регионе APAC для Embraer и True Avgeek.

Господин Прасад объяснил это фактами, данными и отличным способом написания анализа. Он сделал подробный анализ сокращений рейсов British Airways и Qantas, вот картинка, стоящая тысяч слов.

Фото: Васуки Прасад

Фото: Васуки ПрасадОдин потерялся в цене. Один проиграл по требованию. Оба проиграли Китаю.

Васуки Прасад

British Airways (BA) объявила о приостановке своего маршрута Лондон-Пекин, сославшись на операционные проблемы и проблемы с прибыльностью. Это решение подчеркивает сложную динамику, которая влияет на международные авиаперевозки в Китай.

Основная проблема связана с необходимостью избегать российского воздушного пространства, заставляя British Airways идти более длинным южным маршрутом. Это существенно влияет на время полета и эксплуатационные расходы. Сравнительные данные рейсов 8-9 августа показывают, что путешествие British Airways в западном направлении занимает 2 часа и 15 минут дольше, чем прямой маршрут China Southern над Россией.

Это увеличенное время полета приводит к увеличению расхода топлива на 15%, требований к техническому обслуживанию, часам экипажа и использованию самолетов в оба конца. Кроме того, более длинный маршрут несет более высокие сборы за перелет, что еще больше снижает прибыльность.

Несмотря на эти проблемы, спрос на услуги British Airways остается высоким. Данные Sabre показывают, что в то время как China Southern предлагает в 2,5 раза больше мест на маршруте, British Airways имеет непропорционально большую долю доходов, с множителем 1,25.

Фото: Анна Зверева из Таллина, Эстония - China Southern Airlines, B-1167, Boeing 787-9 Dreamliner, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=78133248

Фото: Анна Зверева из Таллина, Эстония - China Southern Airlines, B-1167, Boeing 787-9 Dreamliner, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=78133248Рост затрат, падение доходов

Однако рыночные условия изменились со времен до пандемии. Сабля Данные по ногам, сравнивающие январь и февраль 2024 года с аналогичным периодом в 2019 году, показывают:

- Увеличение числа пассажиров на 29%

- Рост пассажиров на 20% за один рейс

- Снижение выручки от билетов на рейс на 18%

Это сочетание возросших эксплуатационных расходов и снижения выручки за рейс сделало маршрут невыгодным для British Airways.

China Southern, извлекая выгоду из своей способности использовать российское воздушное пространство, выигрывает от вывода British Airways. Китайский перевозчик может предложить более короткое время полета и потенциально более низкие тарифы, потенциально укрепляя свои позиции на этом рынке.

Фото: Роберт Майерс (CC-BY-SA 3.0 AU), CC BY-SA 3.0 au, https://commons.wikimedia.org/w/index.php?curid=99671465

Фото: Роберт Майерс (CC-BY-SA 3.0 AU), CC BY-SA 3.0 au, https://commons.wikimedia.org/w/index.php?curid=99671465Qantas потерпел неудачу из-за снижения спроса

К концу июля 2024 года Qantas (QF) приостановила свой прямой маршрут Сидней (SYD)-Шанхай (PVG), сославшись на низкий спрос на пассажиров.

генеральный директор Кэм Уоллес сообщил, что в последние месяцы рейсы по этому маршруту работали на 50% мощности.

Служба QF 129/130, которая работала пять раз в неделю с конца октября 2023 года по 27 июля 2024 года, столкнулась с жесткой конкуренцией со стороны China Eastern Airlines (MU). Данные Sabre за ноябрь 2023 года по февраль 2024 года показывают, что China Eastern доминирует на маршруте с долей рынка 76% как в полетах, так и в креслах.

Структура доходов маршрута раскрывает сложные схемы поездок:

- 57% прибыли приходится на местный трафик

- 30% от соединений в / из Европы, материкового Китая, Японии и Кореи

- 12% от внутренних связей Австралии и Новой Зеландии

Фото: Аэропорт Брисбен

Фото: Аэропорт БрисбенChina Eastern значительно превзошла Qantas в подключении трафика, захватив 90% доходов от международных связей, а Лондон является ведущим рынком. Это несоответствие подчеркивает конкурентный недостаток Qantas в использовании своей сети для этого маршрута.

На внутреннем и транстасмановском рынке связи, несмотря на небольшое преимущество, Qantas по-прежнему отставала от China Eastern. Распределение доходов от этих соединений составило 30-70% в пользу China Eastern, чему способствовали более высокая частота (3,1 раза по сравнению с Qantas) и обширные соглашения о код-шеринге.

Фото: dnata

Фото: dnataНижняя линия

В отличие от недавней приостановки маршрута British Airways в Пекин, решение Qantas связано с недостаточным спросом на его продукт. Эта ситуация подчеркивает проблемы, с которыми сталкиваются некитайские перевозчики в конкуренции на маршрутах в материковый Китай.

Qantas сохранит свое код-шеринговое соглашение с China Eastern, что позволит ей сохранить некоторое присутствие на рынке без операционных рисков прямого обслуживания. Эта стратегия может помочь Qantas ориентироваться на сложном китайском рынке, ориентируясь на более выгодные маршруты.

Как вы относитесь к такой геополитической напряжённости в международных авиаперевозках? Дайте нам знать ваши мысли в комментариях.

Присоединяйтесь к нам в Telegram Group для последних обновлений авиации. Следуйте за нами в Google News.

Virgin Atlantic отменяет 787 рейсов из Лондона в Шанхай

British Airways и Qantas проиграли китайским авиакомпаниям, но как? Впервые появился на Aviation A2Z.