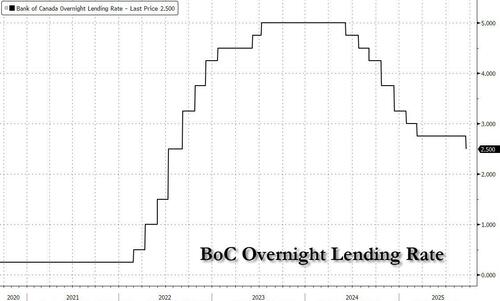

Банк Канады возобновил снижение ставок после 6-месячной паузы

Банк Канады, как и ожидалось, снизил ставки на 25 б.п. до 2,50%. Это было 8-е подряд снижение ставки с начала цикла смягчения год назад, и произошло после того, как банк остановился после последнего снижения ставки в марте, 6 месяцев назад.

Губернатор Тифф Макклем сказал, что, хотя «значительная неопределенность остается», в комитете был «четкий консенсус» в отношении первого снижения ставки с марта, поскольку замедление прироста населения и слабый рынок труда тормозили потребление, в то время как экономика была слабее, и был «меньше риска роста инфляции». Глава BoC пояснил, что «Совет управляющих счел, что снижение ставки было уместным для лучшего баланса рисков в будущем». Кроме того, он отметил, что повышательное давление на ИПЦ уменьшилось.

Банк Англии удалил формулировку из предыдущего заявления, в котором говорилось: «Если ослабление экономики оказывает дальнейшее понижательное давление на инфляцию и сдерживается повышательное ценовое давление от сбоев в торговле, может возникнуть необходимость в снижении процентной ставки».

Еще несколько основных моментов из доклада:

Торговля

- В течение последнего периода торговых потрясений. Совет управляющих проводит тщательную работу, уделяя особое внимание рискам и неопределенности, с которыми сталкивается канадская экономика.

- Тарифы оказывают глубокое влияние на несколько ключевых секторов, включая автомобильную, сталелитейную и алюминиевую отрасли. Китайские тарифы на канолу, свинину и морепродукты, новые тарифы США на медь и более высокие тарифы США на пиломатериалы из хвойных пород еще больше распространят прямое воздействие.

- После сохранения устойчивости к резкому повышению тарифов США и сохраняющейся неопределенности глобальный экономический рост демонстрирует признаки замедления.

Экономика

- Банк продолжит оценивать риски, смотреть на более короткий горизонт, чем обычно, и быть готовым реагировать на новую информацию.

- Появились некоторые признаки устойчивости: потребление было сильнее, чем ожидалось, во втором квартале и активность на рынке жилья увеличилась.

- ВВП Канады снизился примерно на VA% во 2 квартале, как и ожидалось, при этом тарифы и торговая неопределенность сильно повлияли на экономическую активность.

- Экспорт упал на 27% во 2 квартале, резкое изменение с 01 года, когда Cos. спешил с заказами, чтобы опередить тарифы.

- Инвестиции в бизнес также снизились во 2 квартале, в то время как потребление и активность в жилищном секторе росли здоровыми темпами.

- В ближайшие месяцы медленный рост населения и слабость на рынке труда, вероятно, будут влиять на расходы домашних хозяйств.

Инфляция:

- Предпочтительные показатели базовой инфляции в последние месяцы составляли около 3%, но на ежемесячной основе импульс роста, наблюдаемый ранее в этом году, рассеялся.

Впереди:

- Заглядывая в будущее, разрушительные последствия изменений в торговле будут продолжать увеличивать издержки, даже если они влияют на экономическую активность.

- Совет управляющих действует осторожно, уделяя особое внимание рискам и неопределенности.

- GC будет оценивать, как развивается экспорт в условиях тарифов США и изменения торговых отношений.

В резюме: Банк Англии снизил ставки на 25 б/с, как и ожидалось, а губернатор Макклем отметил «четкий консенсус» для смягчения политики. В сопроводительном заявлении говорится, что сокращение было целесообразным, учитывая более слабую экономику и меньшие риски роста инфляции. Кроме того, совет посчитал, что снижение ставки целесообразно для лучшего баланса рисков. На торговом фронте политики сохраняют осторожность в отношении рисков, связанных с тарифными действиями США. Двигаемся вперед. Банк продолжит оценивать риски, смотреть на более короткий горизонт, чем обычно, и быть готовым реагировать на новую информацию.

Немедленно в ответ USDCAD незначительно вырос с 1,3760 до максимума сессии 1,3770, прежде чем вернуться к некоторым шагам с большей частью решения в соответствии с ожиданиями.

Тайлер Дерден

Свадьба, 09/17/2025 - 10:14

![Szkolenia zamiast nowych świadczeń za opiekę nad niepełnosprawnymi i chorymi [Projekt ustawy o opiece długoterminowej]](https://g.infor.pl/p/_files/38661000/paragraf-38661468.jpg)