Перед лицом повышенной геополитической напряженности и последующей экономической неопределенности Центральная и Восточная Европа (ЦВЕ) находится в поворотном моменте. Несмотря на продолжающийся конфликт в Украине и изменение глобальной динамики после президентских выборов в США, 2025 год станет переломным годом для инвестиций в инфраструктуру во всем регионе. Недавнее Доклад о перспективах ЦВЕ Исследование, опубликованное Amber Infrastructure, подтверждает эту оценку, подчеркивая как проблемы, так и исключительные возможности, которые определяют текущий ландшафт.

Десятилетие устойчивости и роста

За последнее десятилетие регион ЦВЕ последовательно зарекомендовал себя как двигатель роста Европейского Союза. Поскольку рост ВВП регулярно опережает западноевропейские рынки, а прямые иностранные инвестиции идут беспрецедентными темпами, устойчивость региона перед лицом последовательных кризисов - от пандемии до войны в Украине - была замечательной. Согласно отчету CEE Outlook Report, доля финансирования из-за пределов Европы выросла с девяти процентов в 2022 году до 21 процента в прошлом году, что свидетельствует о растущем международном признании потенциала региона.

Эта устойчивость не случайна. Это связано с уникальной конвергенцией факторов, которые делают ЦВЕ особенно привлекательным для инвесторов в инфраструктуру. Членство в ЕС обеспечивает стабильность регулирования, значительные потребности в развитии инфраструктуры и скорректированную с учетом риска доходность, которая часто превосходит западноевропейские альтернативы.

Проблемы, стоящие перед регионом, реальны. Близость к войне в Украине по своей сути создает неопределенность, в некоторых странах усиливается политическая поляризация, а стареющее население представляет долгосрочные демографические проблемы. Некоторые правительства также имеют ограниченный опыт управления крупномасштабными инфраструктурными проектами, что может привести к задержкам в закупках и проблемам с осуществлением.

Тем не менее, именно эти проблемы дают новый импульс для удовлетворения основных потребностей инфраструктуры и достижения большей устойчивости. Слияние геополитического давления и экономических возможностей создало то, что может быть инвестиционным ландшафтом раз в поколение. По мере усиления поляризации между Россией и ЕС появилась замечательная политическая и коммерческая воля к созданию устойчивости инфраструктуры, от энергетики до транспорта и цифровизации.

Транспорт: повышение устойчивости посредством подключения

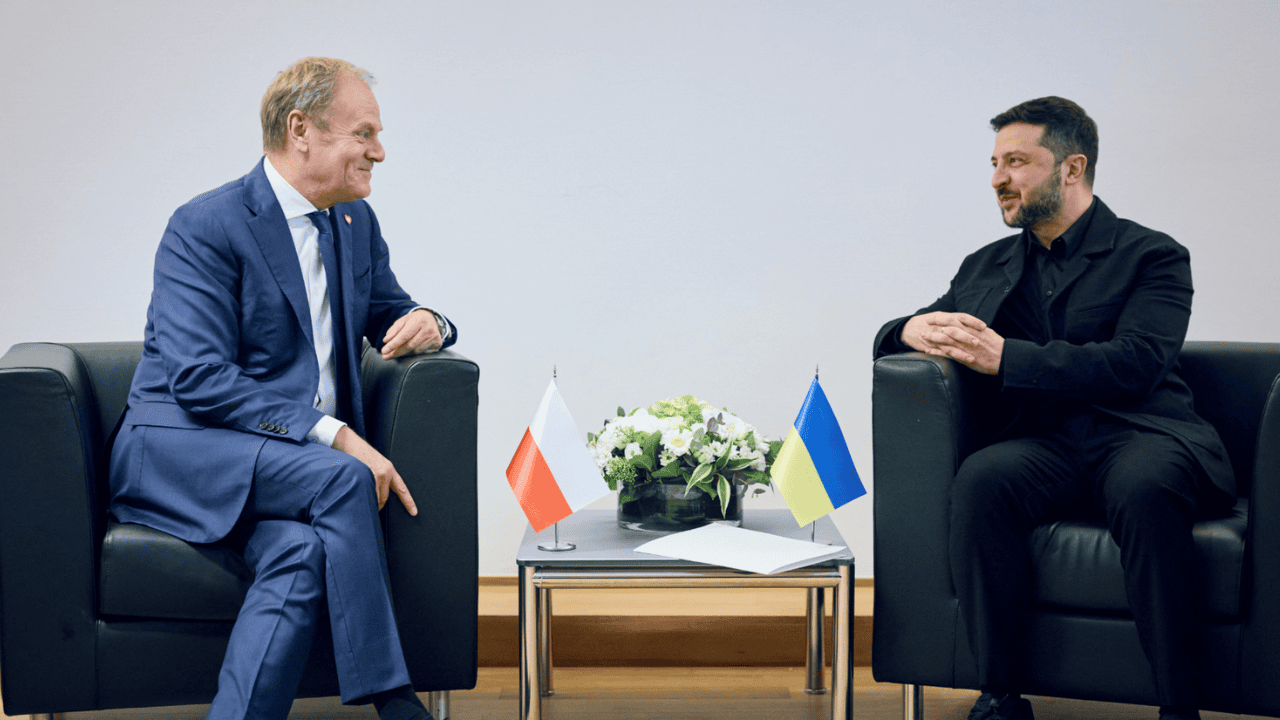

Возьмем, к примеру, транспортный сектор, где перебои в цепочках поставок ускорили модернизацию. Польско-украинский железнодорожный транспорт демонстрирует значительный рост. 28-процентное увеличение объемов грузов в начале 2024 года по сравнению с 2023 годом. Крупные проекты, такие как Центральный коммуникационный порт Польши, представляют собой масштаб амбиций, интегрируя воздушную, железнодорожную и автомобильную связь с инвестициями в размере около 31 миллиарда евро к 2032 году.

Расширение коридоров Трансъевропейской транспортной сети (TEN-T) создает значительные инвестиционные возможности как в новой инфраструктуре, так и в модернизации существующих активов. Эти проекты пользуются приоритетным статусом для финансирования и нормативной поддержки ЕС, что повышает их привлекательность для международных инвесторов. Фонд «Связь Европы» совместно с многочисленными национальными инвестиционными программами позиционирует транспортную инфраструктуру в качестве правительственного приоритета во всем регионе, а модели государственно-частного партнерства формируют ключевой метод стимулирования инвестиций.

Этот акцент на связи между севером и югом имеет решающее значение для региональной интеграции. Такие проекты, как Rail Baltica, поддерживаемые как финансированием ЕС, так и национальными инвестиционными программами, имеют ключевое значение для преодоления разрыва в инфраструктуре, а также создают дополнительные возможности для частных инвесторов. Геополитические обстоятельства привели к ускорению роста трансграничной инфраструктуры, на развитие которой в нормальных условиях ушло бы десятилетия.

Трансформация энергетики: безопасность отвечает устойчивости

В энергетике регион переживает беспрецедентную трансформацию. Амбициозная цель ЕС в 42,5% потребления возобновляемой энергии стимулирует значительные инвестиции в солнечные и ветровые мощности. ЦВЕ лидирует по относительному росту в этом секторе. Например, Польша увеличила свою солнечную мощность на 37 процентов в первой половине 2024 года, а Венгрия - на 49 процентов..

Война на Украине ускорила императив энергетической независимости. Это привело к замечательным событиям, таким как польский оператор электросетей PSE, планирующий инвестировать около 15,2 млрд евро к 2034 году. Такие инвестиции приведут к появлению некоторых из крупнейших возобновляемых инфраструктурных возможностей в Европе, с установленными нормативными рамками, поддерживающими частные инвестиции и стимулы для продвижения перехода на возобновляемые источники энергии.

Участие частного сектора в рамках корпоративных соглашений о покупке электроэнергии (PPA) создает стабильную инвестиционную среду, даже если государственная политика развивается. Такие компании, как Enery, владеющая портфелем активов операционной генерации мощностью 490 МВт и значительным портфелем разработок мощностью ~8 ГВт+ в странах Центральной и Восточной Европы, продемонстрировали жизнеспособность этой модели. Использование ими физических и виртуальных ППА обеспечило стабильность в условиях, когда правительства обычно пересматривают субсидии и стимулы энергетического сектора.

Цифровая революция CEE

Возможно, самым захватывающим является бум цифровой инфраструктуры, происходящий во всем регионе ЦВЕ. В то время как страны Балтии стали выдающимися лидерами с их ростом на 360 процентов в сфере Deep Tech за последние пять лет, цифровая трансформация происходит по всей Центральной и Восточной Европе. Такие города, как Варшава, Прага и Бухарест, становятся ключевыми технологическими центрами.

Эта региональная цифровая революция создает разнообразные инвестиционные возможности в специализированной цифровой инфраструктуре. От модернизации сети до развертывания и оптоволоконной инфраструктуры 5G, а также интеграции цифровых возможностей с традиционными транспортными коридорами, трансформация носит комплексный характер. Коридор 5G Via Baltica иллюстрирует эту тенденцию, когда модернизация транспортной инфраструктуры сочетается с передовым развертыванием телекоммуникаций, создавая множество точек входа для инвесторов в разных секторах.

Инновационные центры развиваются по всему региону, с известными проектами, такими как Центры обработки данных Greenergy в Таллинне, который создал один из самых энергоэффективных центров обработки данных в Северной Европе. Модульная конструкция, работающая на 100% возобновляемой энергии, обеспечивает масштабируемость, сохраняя при этом защиту инфраструктуры с помощью систем мониторинга и эффективности на основе искусственного интеллекта.

Инвестиции в инфраструктуру ЦВЕ

Что делает 2025 год особенно привлекательным для инвесторов в инфраструктуру, так это мощное сочетание институциональной поддержки, различных точек входа на рынок и стратегического значения. Инвестиционный фонд «Инициатива трех морей» (3SIIF) уже выделил 850 миллионов евро на проекты в области энергетики, транспорта и цифровой инфраструктуры.

Для международных инвесторов ЦВЕ предлагает уникальное предложение: потенциал роста развивающихся рынков со стабильностью ЕС. Различные этапы либерализации рынка в регионе создают множество точек входа для различных инвестиционных стратегий, от стабильной, регулируемой доходности на более развитых рынках до более высоких возможностей роста в быстро развивающихся. Это разнообразие охватывает от передовых в цифровом отношении стран Балтии до Центральной Европы, ориентированной на производство, и стратегически расположенных Балкан, с их доступом к ключевым морским маршрутам.

Сближение участия частного сектора и растущее стратегическое значение региона создают редкое окно возможностей. Инфраструктурные инвестиции здесь выходят за рамки финансовой отдачи. – Речь идет об участии в преобразовании региона, который становится все более центральным для экономического будущего Европы и архитектуры безопасности. ЦВЕ предлагает непревзойденное предложение в проектах, поддерживаемых безопасными структурами, расширенным потенциалом роста и активами, критически важными для будущей экономической безопасности ЕС.

Ожидается, что в регионе будет наблюдаться быстрый рост экономического роста и значительное увеличение объемов инвестиций в инфраструктуру. Рынок ЦВЕ уже закрепился как один из мировых конкурентов. По мере того, как регион вступает в следующую фазу развития инфраструктуры, возможности процветают.

Кристиан Рой Является главой Центральной и Восточной Европы в Amber Infrastructure.

Пожалуйста, поддержите Новая Восточная Европа краудфандинговая кампания. Пожертвуйте, нажав на кнопку ниже.